Table of Content

Up to 1.50% of the loan amount or ₹4,500 whichever is higher, plus applicable taxes. All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch. A combination loan is part fixed and part floating. Post the fixed rate tenure, the loan switches to an adjustable rate. You can submit a request for the disbursement of your loan online or by visiting any of our offices.

Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. Ensure that the documentation of your home loan application is in order as per the requirement of the lender. If the property you want to purchase is under construction, we will disburse the sanctioned amount in instalments to the developer based on the progress of construction. Based on our assessment, we will determine your loan eligibility. If you’ve had a long-standing relationship with HDFC Bank and have paid all your past loans with them, you will be eligible for an HDFC Bank pre-approval.

EMI Calculators

The section labelled “Track Your Application” may be found on the following page. Your User ID and password, which were provided to you at the time of application, should be entered into the two fields below. On the next page, you can see the status of your application for a mortgage. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan.

You can get real time updates of the status on the app or on the website. You can also call the customer care number given in the section above and get your details with a missed call or SMS. You must be aware of the status of your loan application after submitting it. There are several ways to accomplish this and for your convenience, this article explains the ways you can check your HDFC home loan application status. For home loan approval, you need to submit the following documents for all applicants / co-applicants along with the completed and signed home loan application form. You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

How do I Improve My Chances of Getting a Home Loan?

FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income. The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes. Check with the lender if the property that you have shortlisted will be considered for a housing loan.

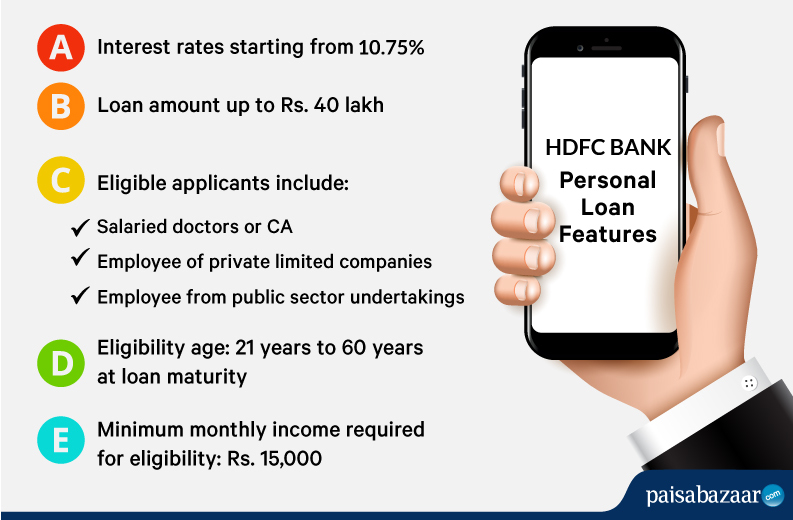

HDFC Bank customers can make use of the personal loan eligibility calculator to know if they are eligible. The eligibility calculator will take into consideration the age of the applicant, income, loan amount and tenure chosen, etc. You can check your HDFC Bank personal loan status on the website of HDFC Bank or at the nearest branch of HDFC Bank.

Checking your browser before accessing www.hdfcbank.com.

Enter either the name of the applicant or the reference/proposal number. You will then have to enter either the date of birth or the mobile number of the applicant. If you haven’t applied for a loan already, you may apply for a new loan under this section. Home Loans at floating interest rate offer you ultimate prepayment flexibility. You can prepay early & reduce interest cost as per your cash flows.

Select the loan product you would like to apply for. You will be taken to the loan application form where the details you have already provided will be prefilled. Fill in the balance details – your date of birth and password and click on ‘Submit’. What details do you require to check the status of your home loan application?

Adjustable Rate Home Loans

Avail our home loan services from the comfort of your home! Visit the HDFC Insta Branch on our Instagram page today. Housing Development Finance Corporation Limited (“HDFC”) & HDFC Sales is not an Investment Advisor and does not provide any investment or financial planning advice.

Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. There has been a significant reduction in GST rates on home purchase. We'll ensure you're the very first to know the moment rates change. Till now, I am highly satisfied with the services provided by HDFC.

When the applicant wants to borrow an amount that is beyond their eligibility. It is a loan to extend or add space to your home such as additional rooms and floors etc. Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan. To choose the right home loan for one’s self, the following points should be kept in mind. Please click here to go to English version of the same page.

Very fast, easy systematic application for home loan applying. For people like us with a busy schedule hassle-free service online without visiting the bank was really a lifesaver. Your contributions are pooled in a pension fund and the savings are managed by professional fund managers.

Just keep the Application ID or Reference Number that you received while applying for the Home Loan handy. You will then be required to upload all the documents. The status of your loan will be displayed on the next screen. Guidance on every level has make it hassle free.

With minimal documentation, applying for a HDFC home loan is quick and hassle free. Our home loan experts are available to help you in your loan application process and offer you assistance every step of the way. If you have already applied for the loan, you can choose the personal loan option in this app and check your application status.

It was overall good experience from starting phase I.E. From loan approval to till now that is disbursement. All the staff was supportive enough to get me through this entire process. Home Development Finance Corporation Ltd has hiked its Retail Prime Lending Rate by 35 basis points with effect from December 20, 2022. HDFC home rates to start from 8.65 % onwards for credit score of 800 & above.

No comments:

Post a Comment